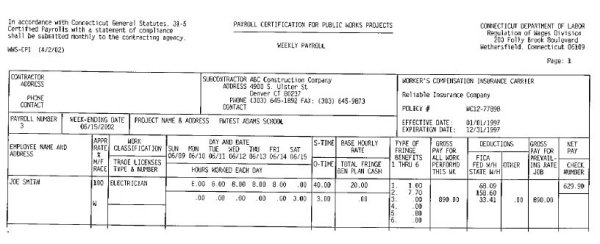

The new CT State Certified Payroll form is here and the CT DOL is requiring its use. The form pictured here is easily created by TACT. TACT stores the information about each type of Benefit (as described in the Compliance Page below). And TACT makes it so easy for you to get the most credits available.

The new CT State Certified Payroll form is here and the CT DOL is requiring its use. The form pictured here is easily created by TACT. TACT stores the information about each type of Benefit (as described in the Compliance Page below). And TACT makes it so easy for you to get the most credits available.

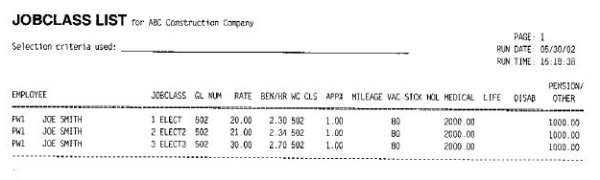

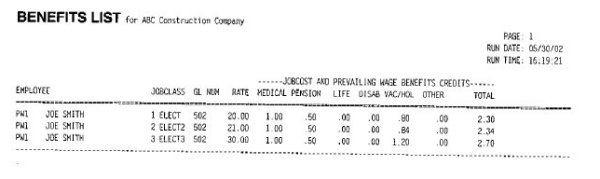

You simply tell TACT how many hours of Vacation, Sick and Holiday time off you provide each employee. Then you tell TACT what you pay for Health, Life and Disability Insurance, Pension and other benefits. TACT then calculates each benefit precisely to minimize the cash paid to the employee (thus minimizing employer taxes) and to report on the new Certified Payroll Report.

You simply tell TACT how many hours of Vacation, Sick and Holiday time off you provide each employee. Then you tell TACT what you pay for Health, Life and Disability Insurance, Pension and other benefits. TACT then calculates each benefit precisely to minimize the cash paid to the employee (thus minimizing employer taxes) and to report on the new Certified Payroll Report.

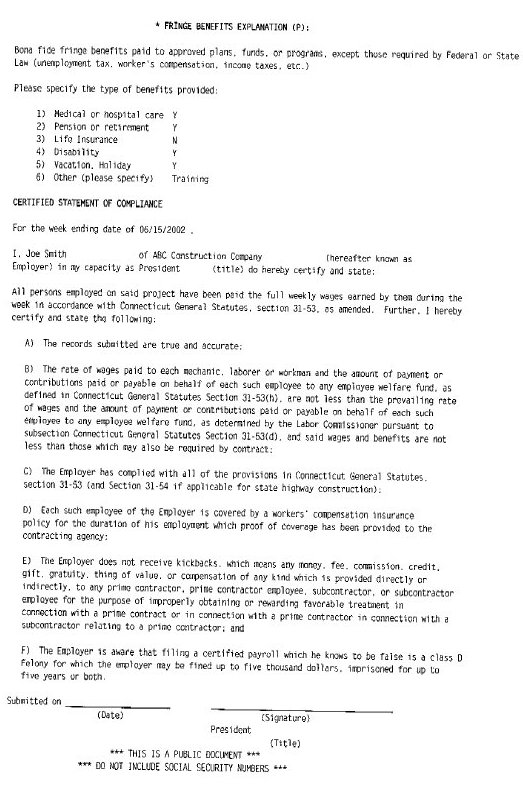

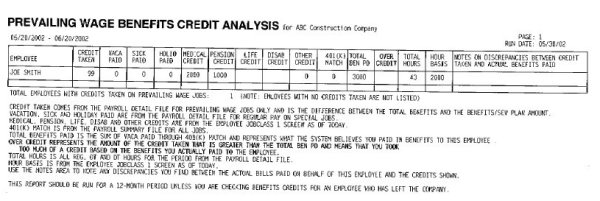

If you are audited, you can simply print the Prevailing Wage Benefit Credit Analysis report which shows exactly how the credits were calculated and whether or not you exceeded the allowed amount. This makes your audit a breeze.

If you are audited, you can simply print the Prevailing Wage Benefit Credit Analysis report which shows exactly how the credits were calculated and whether or not you exceeded the allowed amount. This makes your audit a breeze.

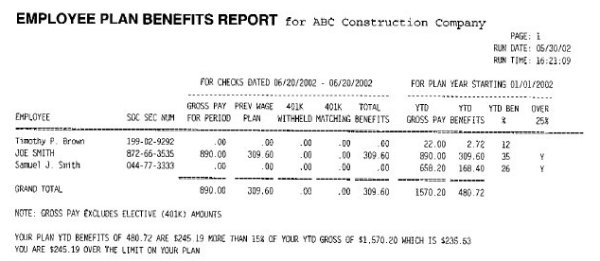

Periodically you can print the report below to see where your employees stand for the year in regards to pension benefits. This report combines both a prevailing wage benefit plan (such as Beneco) with any company matching to voluntary 401(k) contributions to show you what percentage of the employee’s gross pay has been given in pension benefits. Depending on your pension plan, you would use this report to check that you have not exceeded the rules of your plan.

Periodically you can print the report below to see where your employees stand for the year in regards to pension benefits. This report combines both a prevailing wage benefit plan (such as Beneco) with any company matching to voluntary 401(k) contributions to show you what percentage of the employee’s gross pay has been given in pension benefits. Depending on your pension plan, you would use this report to check that you have not exceeded the rules of your plan.

And if you are using the Beneco plan, the report below helps you to complete the Schedule A.

And if you are using the Beneco plan, the report below helps you to complete the Schedule A.

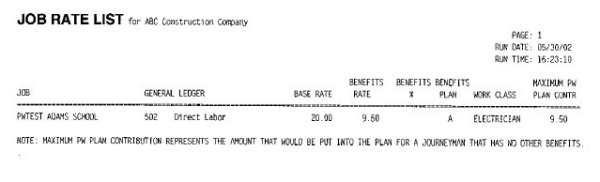

So, as you can see, TACT does it all ?calculates the proper rate to be paid on ANY number of jobs, completes the forms properly and gives you all the reports you need to prove you’ve done it right!

So, as you can see, TACT does it all ?calculates the proper rate to be paid on ANY number of jobs, completes the forms properly and gives you all the reports you need to prove you’ve done it right!

|